Small Ords… 20yrs on

Opening the aperture on the growth of the S&P/ASX Small Ordinaries Index over the past two decades makes for interesting reading.

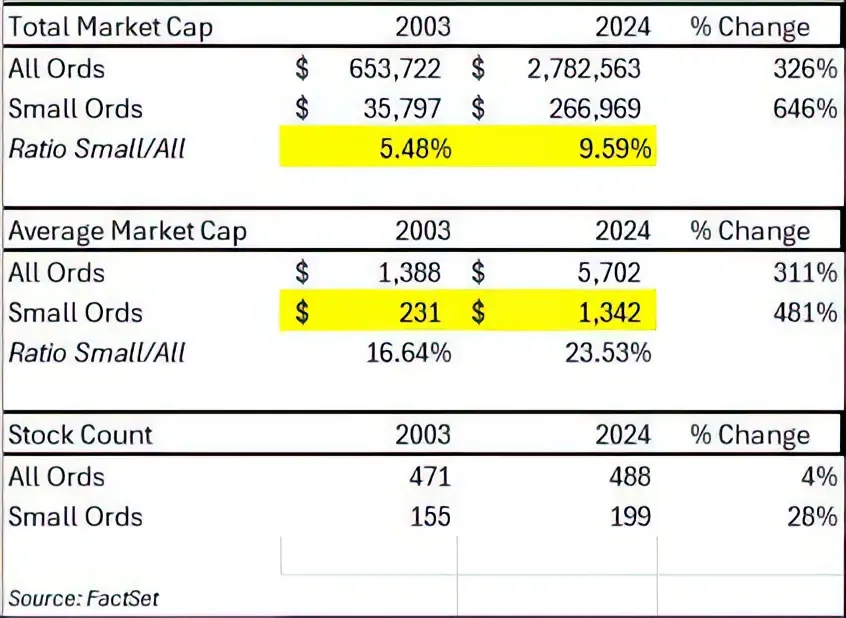

-In 2003, when Eley Griffiths Group launched its first retail fund, the small cap part of the market was ~5.5% of the ASX. Today the small cap share is approaching 10%.

-Further, the average small company market capitalisation has grown from ~$231m to ~$1.34b, a near 6-fold increase over the period.

-With this maturation comes a noticeable improvement in both index and company quality, as well as a wider investor audience.

-The need for diligent and experienced investment managers in the space today is no less important!