2025 Earnings outlook

-Encouraging to read of the growing confidence around the 2025 earnings outlook for the S&P500. Goldman Sachs believe 2025 eps growth will be ~11%, following on from ~8% in 2024. This sits a notch below market consensus at ~ 13% for 2025.

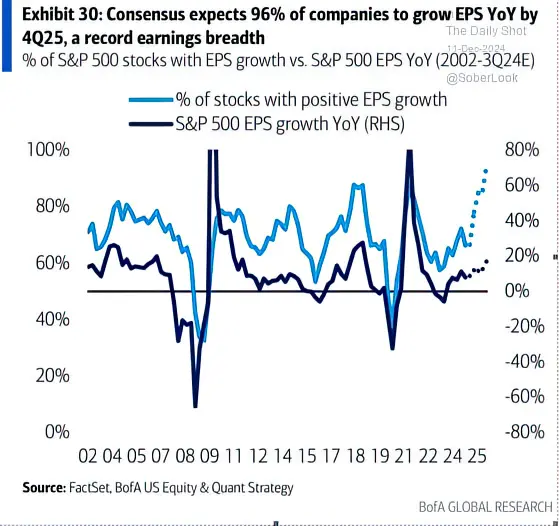

-An interesting chart from the team at BofA Global Research highlights the broadening participation in this earnings improvement. More companies will report +ve eps growth, and logically this trend will progressively capture a recovery in mid and small cap companies earnings.

-A recent FactSet Insight piece investigated the accuracy of bottom-up eps estimates for the S&P500, one year in advance, armed with 25 years of data. Analysts were too bullish 17/25 years and too bearish in 8. The average overstatement in any given year was ~6.3%, noting this included 4 periods where the miss was >25% (eg COVID, GFC years). If the extreme years are removed the overestimate contracts to ~1.1%. Pretty good I’m thinking.

– FactSet median 2025 S&P500 eps today sits at US$275.24 per share. Applying the 1.1% risk factor results in US$272.21 per share for 2025, assuming no disasters in Q4 2024 results. Thats one to diarize and return to this time next year.